Equity markets

After 3 weeks of losses, stock market rebounded this week with S&P gaining 1.9% for the week. It bounced off the 200 day moving average. The support above the multi-month downward trend line helped as well. Nasdaq outperformed with a 2.5% gain for the week. Nothing significantly changed on the fundamental data this week.

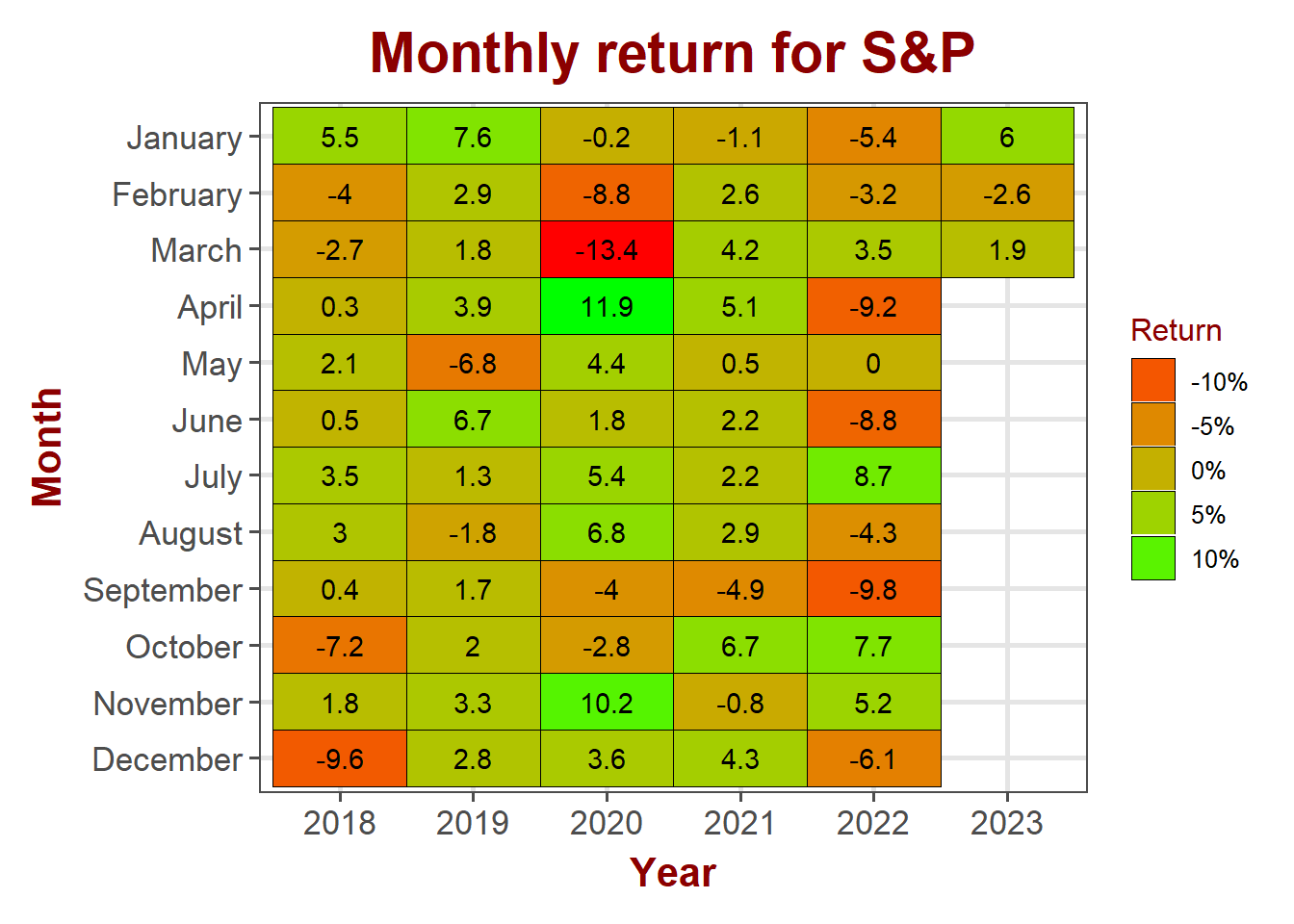

S&P 500

S&P 500 lost ~2.6% for the month of February. But the index has a strong start to March gaining 1.9% so far in the first 3 days of March.

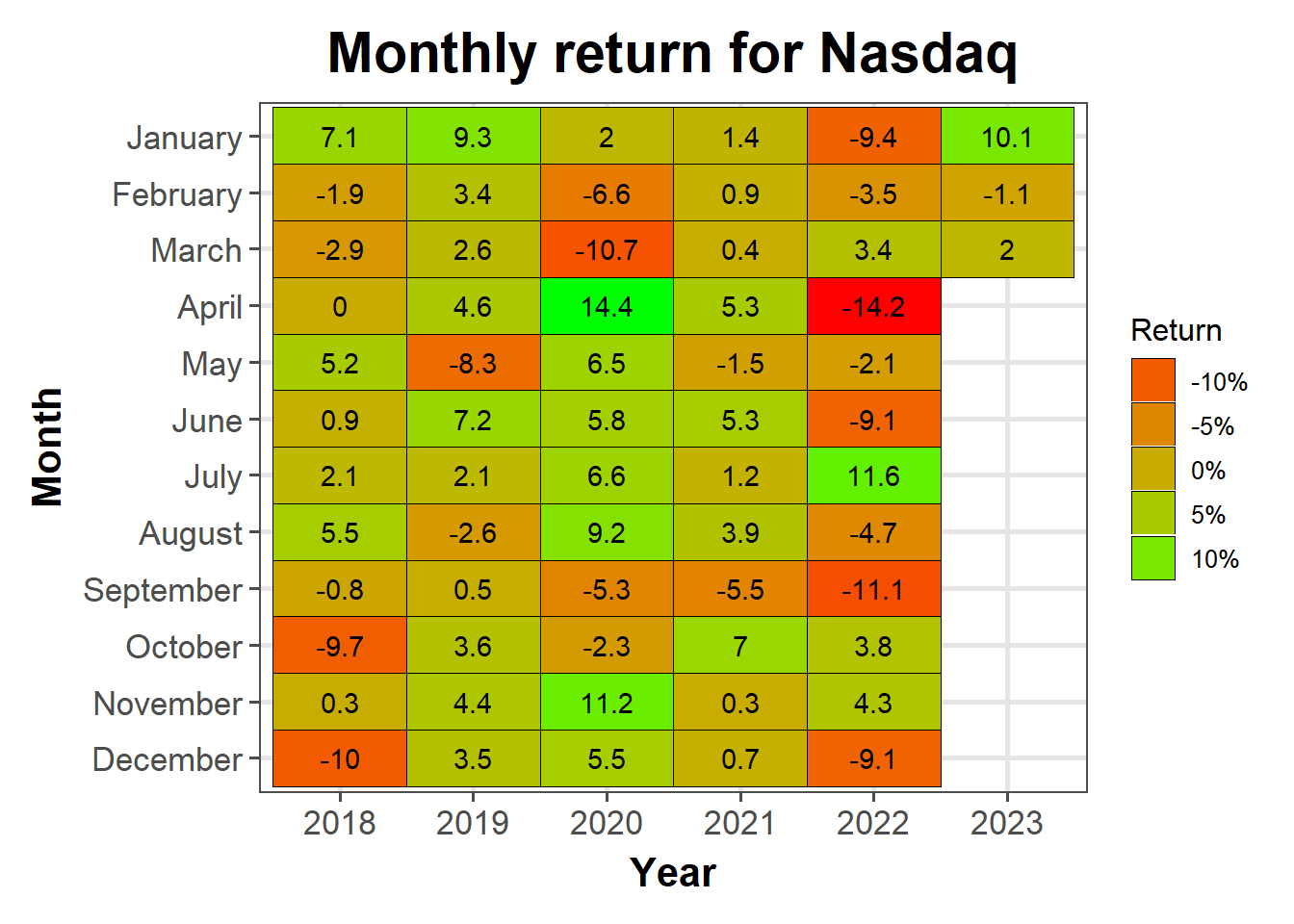

NASDAQ

Technology stocks lost ~1.1% in February. Like S&P, it enjoyed a strong start to March with 2% gain in the first 3 days of March. Nasdaq continues to outperform S&P this year.

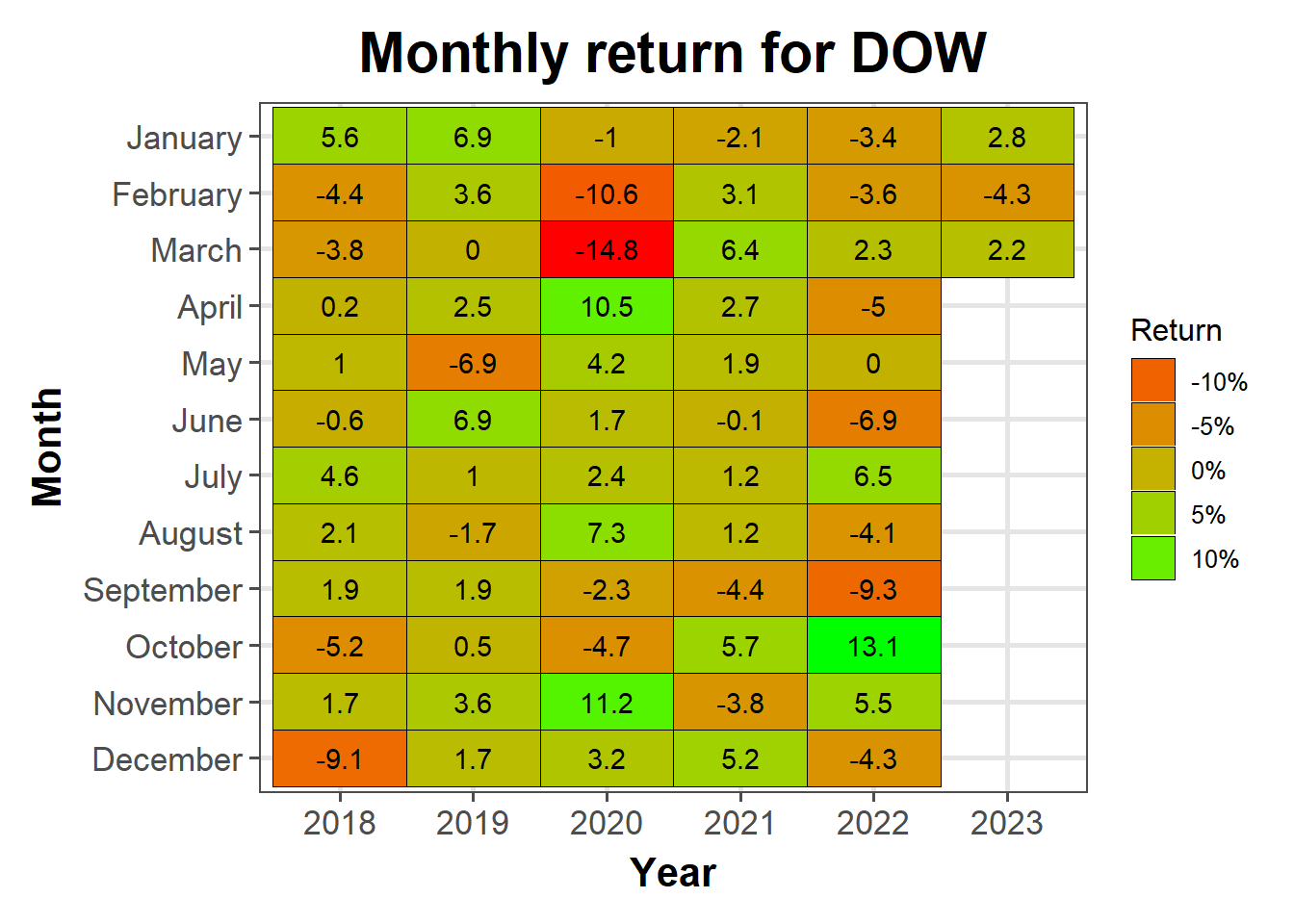

DOW Jones

DOW Jones lost ~4.3% in February. It started March with strong gains; 2.2% in the first three trading days. For the first time this year, DOW performance is on par with S&P and Nasdaq, although it is too early to read too much into this with just three trading days into March.

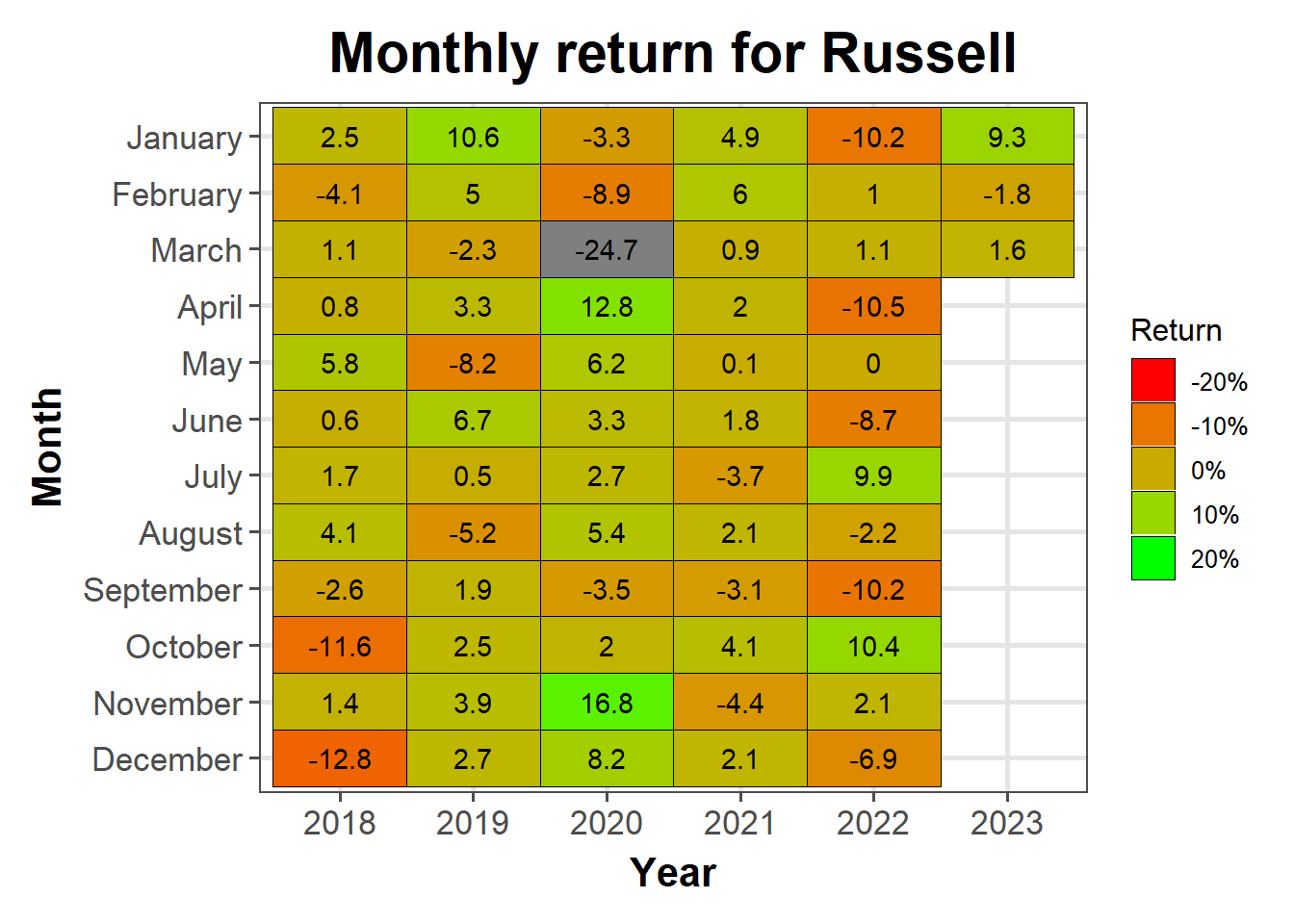

Russell

Small cap stocks lost ~1.8% for the month of February but quickly regained almost all of the loss in the first week of March.

Bond markets

## [1] "DGS3MO" "DGS6MO" "DFF" "DGS1" "DGS2" "DGS5" "DGS7" "DGS10"

## [9] "DGS30"

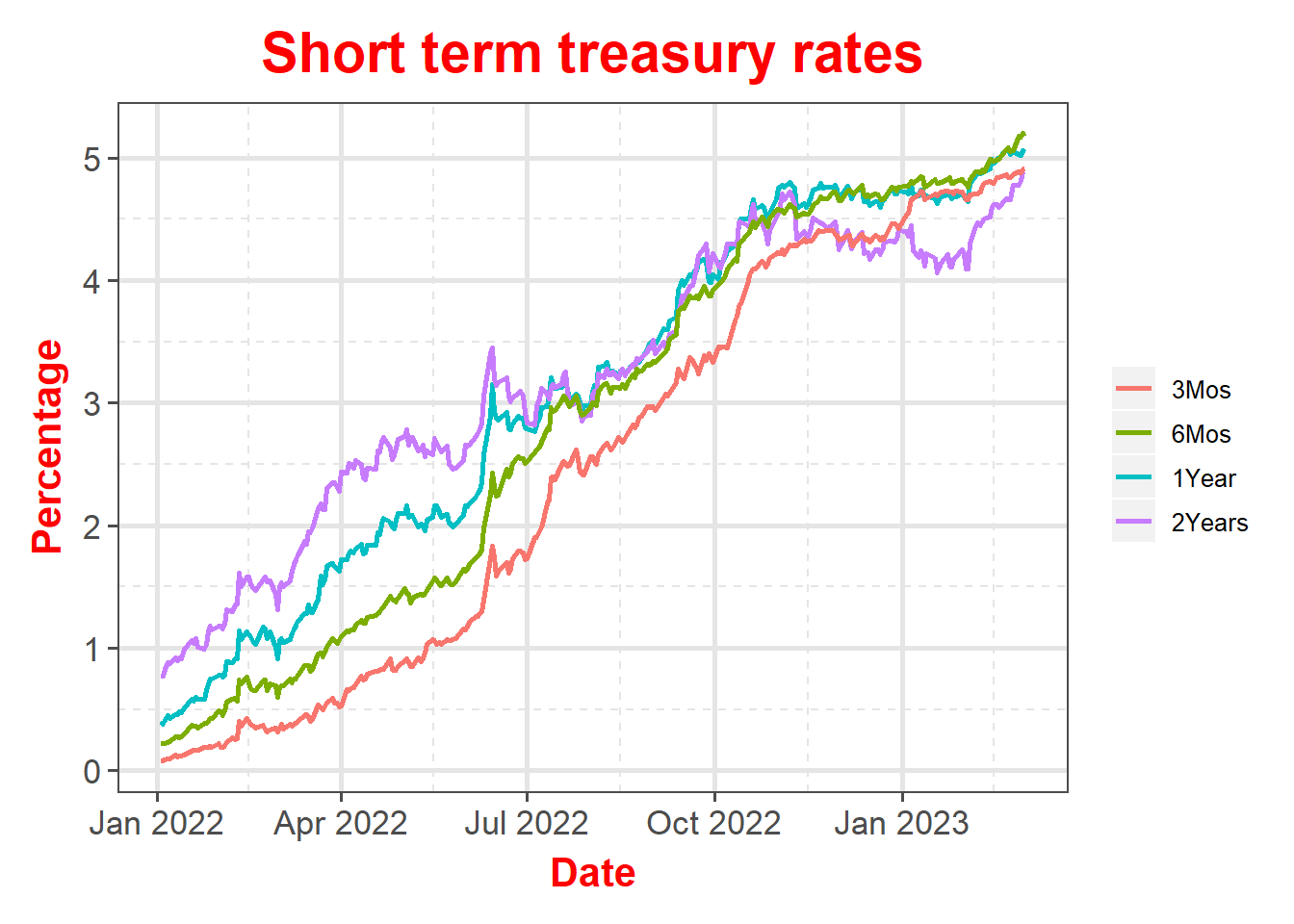

Interest rates

Treasury yields starting to inch up for the year across the yield curve. Two year is closing the gap on the 3-months and appears to be headed above the short term 3-month. This sharpens the yield curve inversion, which may not be good news for stocks. 1-year and 2-year are practically hugging each other.

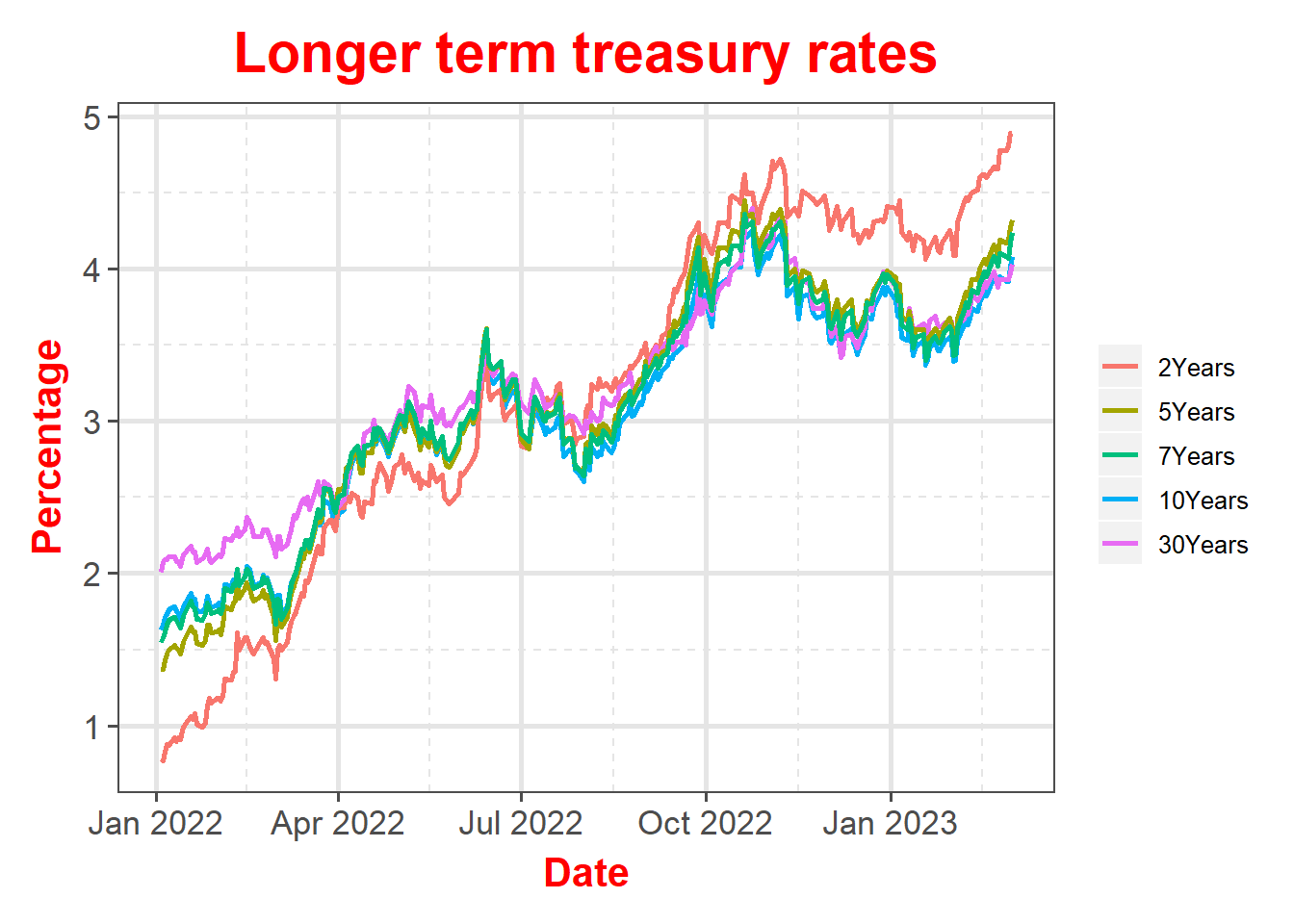

On the longer term, all rates are trending up but the 2-year is uncomfortably higher than the rest of the terms. While all longer terms are higher than 4%, 2-year is flirting with 5% mark.

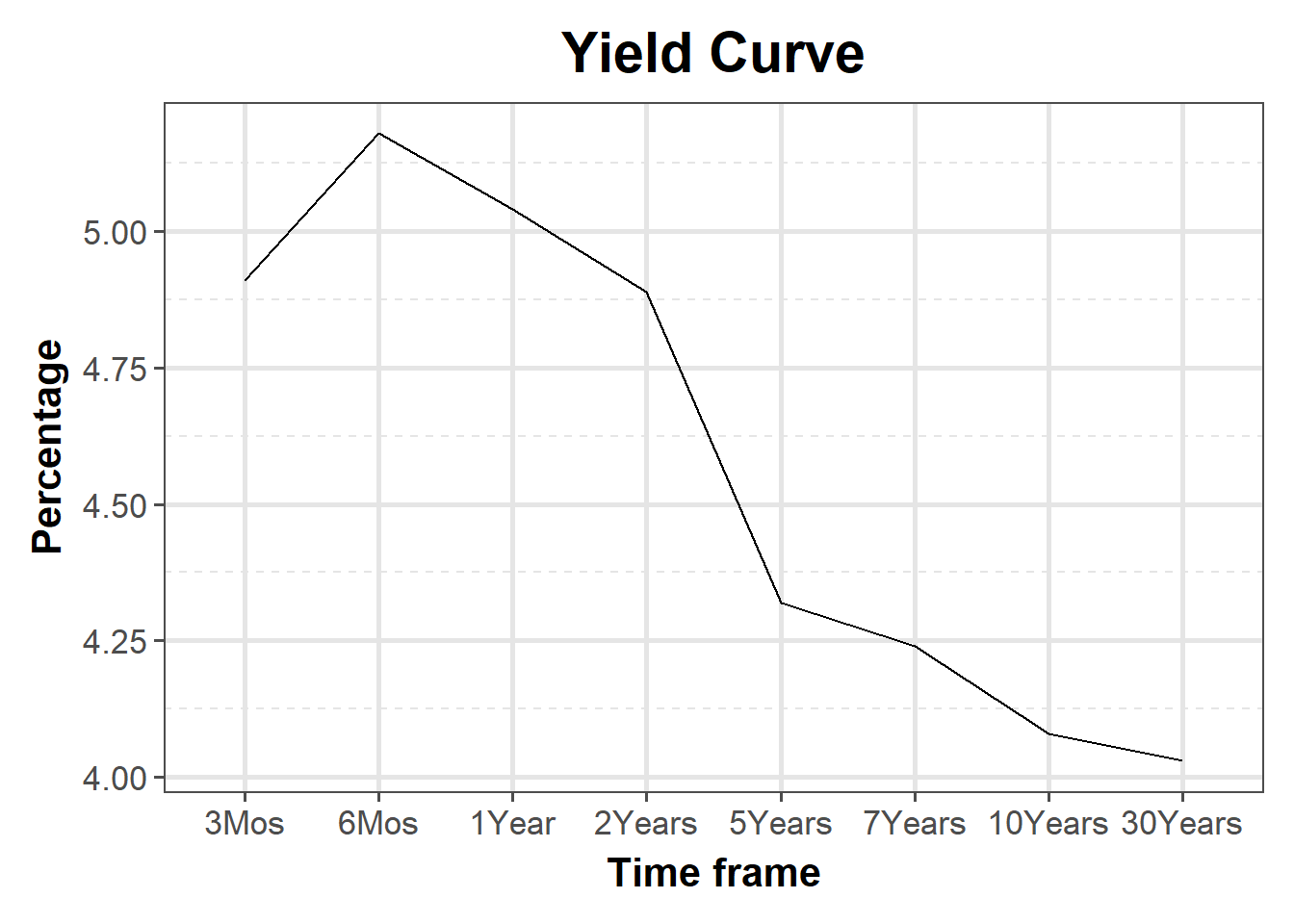

Yeild Curve

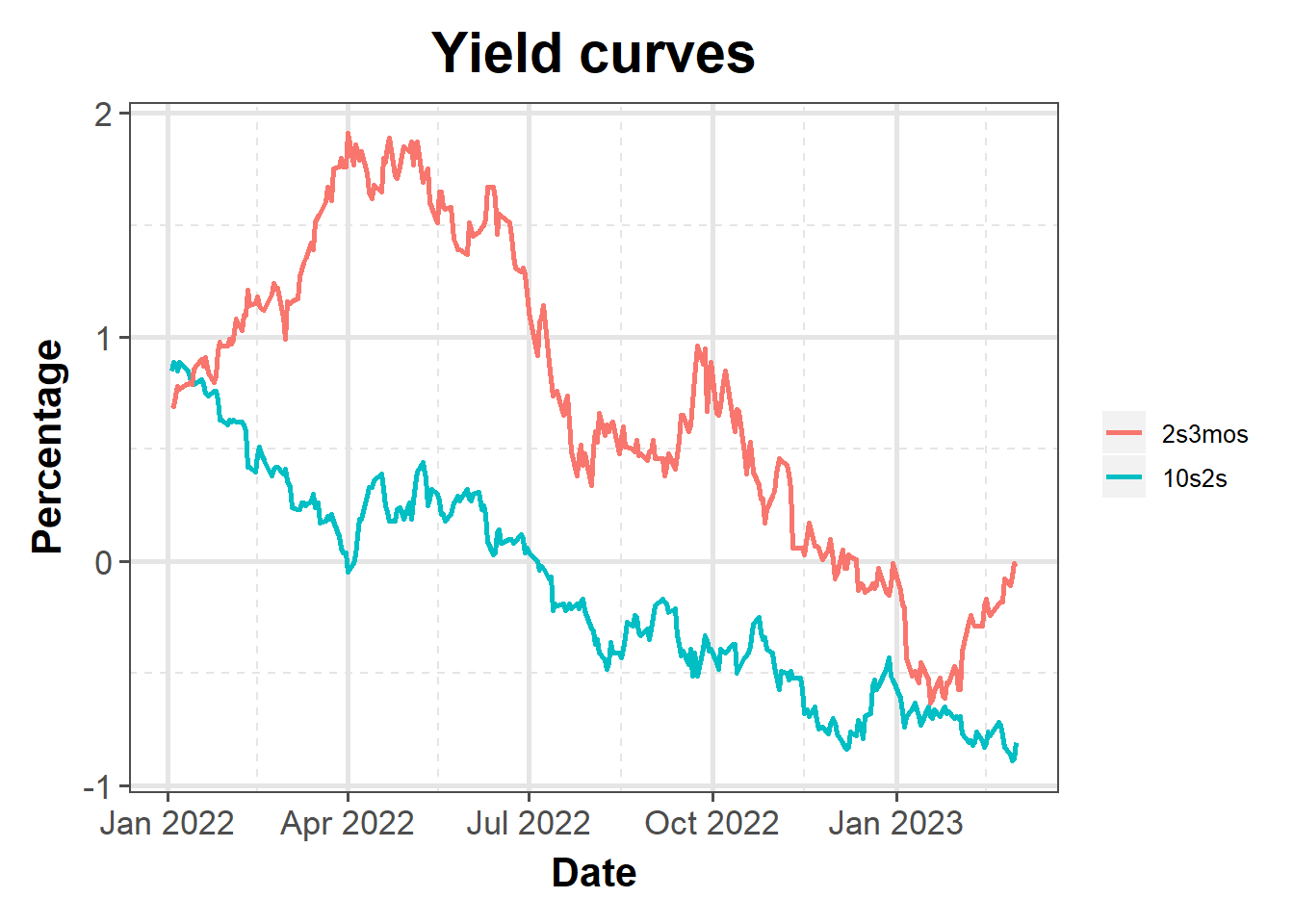

Yield curve continues to slope negatively (inverted). At the higher end, it appears that it is starting to flatten but at the lower end, it still slopes significantly negative. The steep negative slope between 2-year and 5-year is uncomfortably high.

Despite the screams from the bond market, equity markets showing strength. Investors appears to be pricing that the yields have more downside than upside from here thus ignoring the screams from bond markets for now. The path that inflation takes over the next few months decides who is correct.

Disclaimer

Anything on this blog is not an investment advice. It is essential that you fully understand the risks involved before making any investment decisions. You should consult with a financial professional to help you assess your risk tolerance and to determine an investment strategy that is suitable for your individual needs.

Please note that this disclaimer is not exhaustive and is provided for informational purposes only. Investing involves risks, and it is your responsibility to carefully consider the risks before making any investment decisions.