Equity markets

Equity markets were still consolidating last week above the 200 day moving averages. CPI day last week couldn’t provide any resolution to the markets on either side.

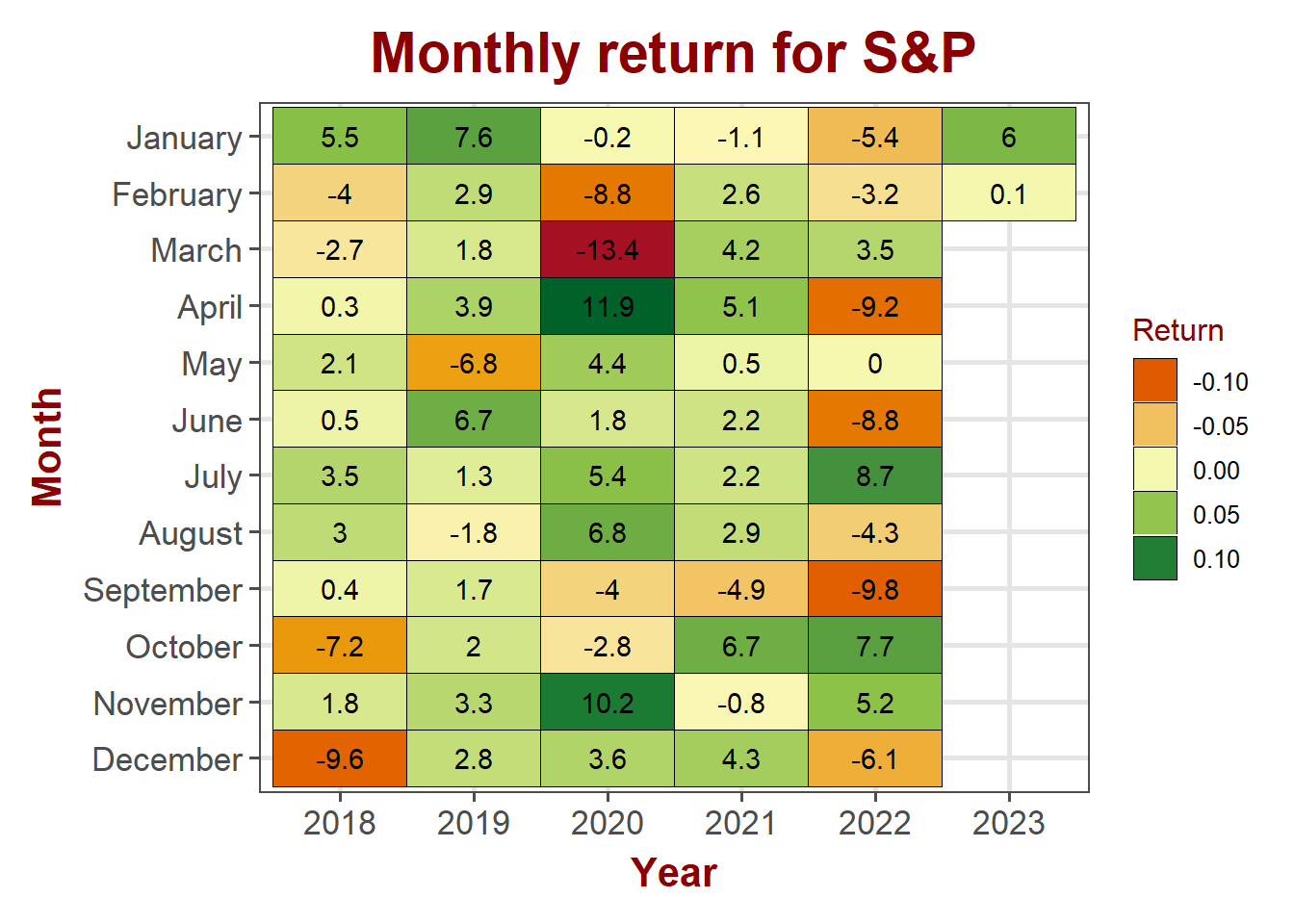

S&P 500

S&P 500 lost ~0.3%, consolidating above the 200 day moving average. Bulls so far managed to hold support and the consolidation appears like a bull flag above 200 day moving average. Technically, S&P looks like it is ready to break out in the next week or two.

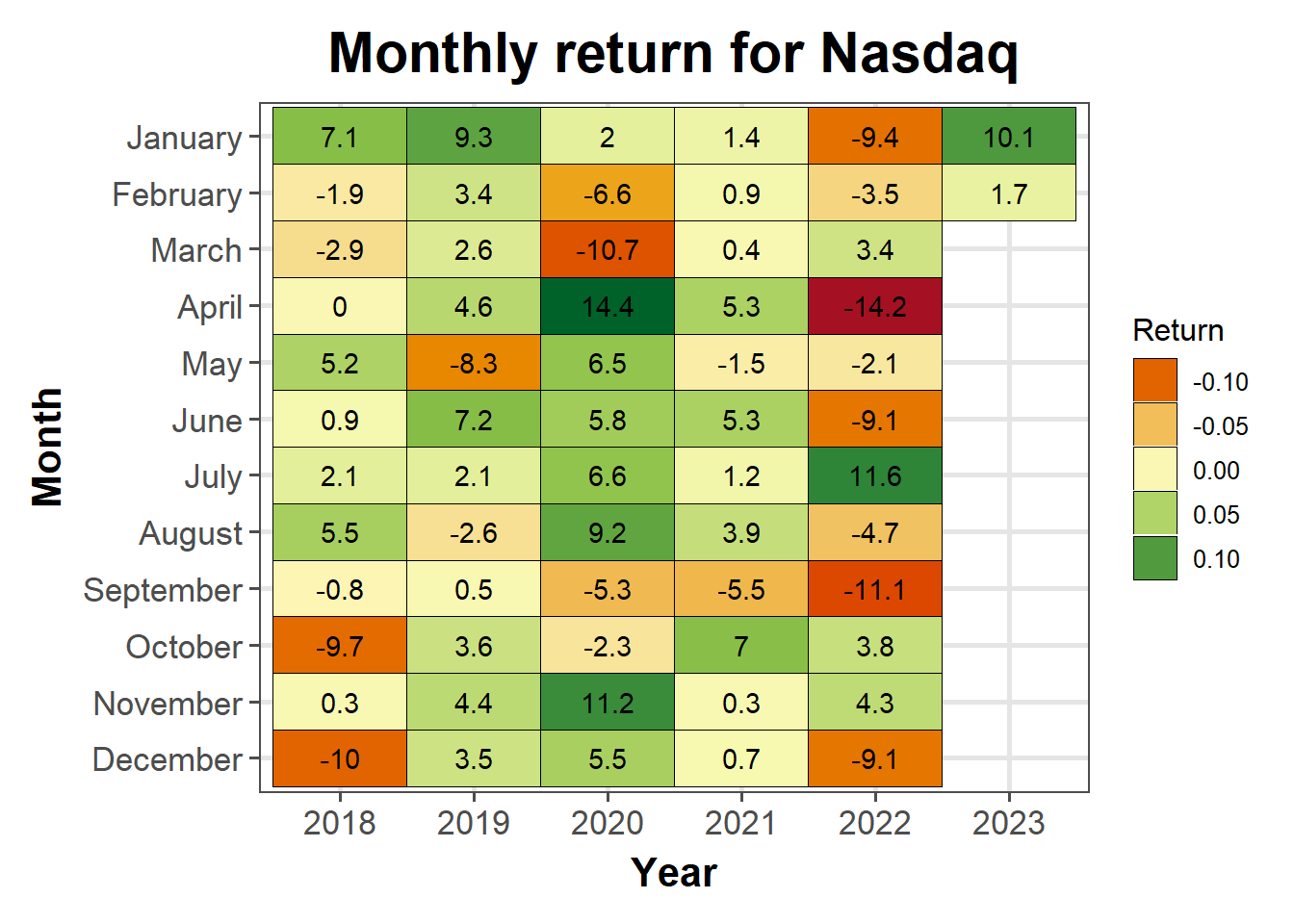

NASDAQ

Technology stocks gained ~0.6% in the week for a month to date gain of 1.7%

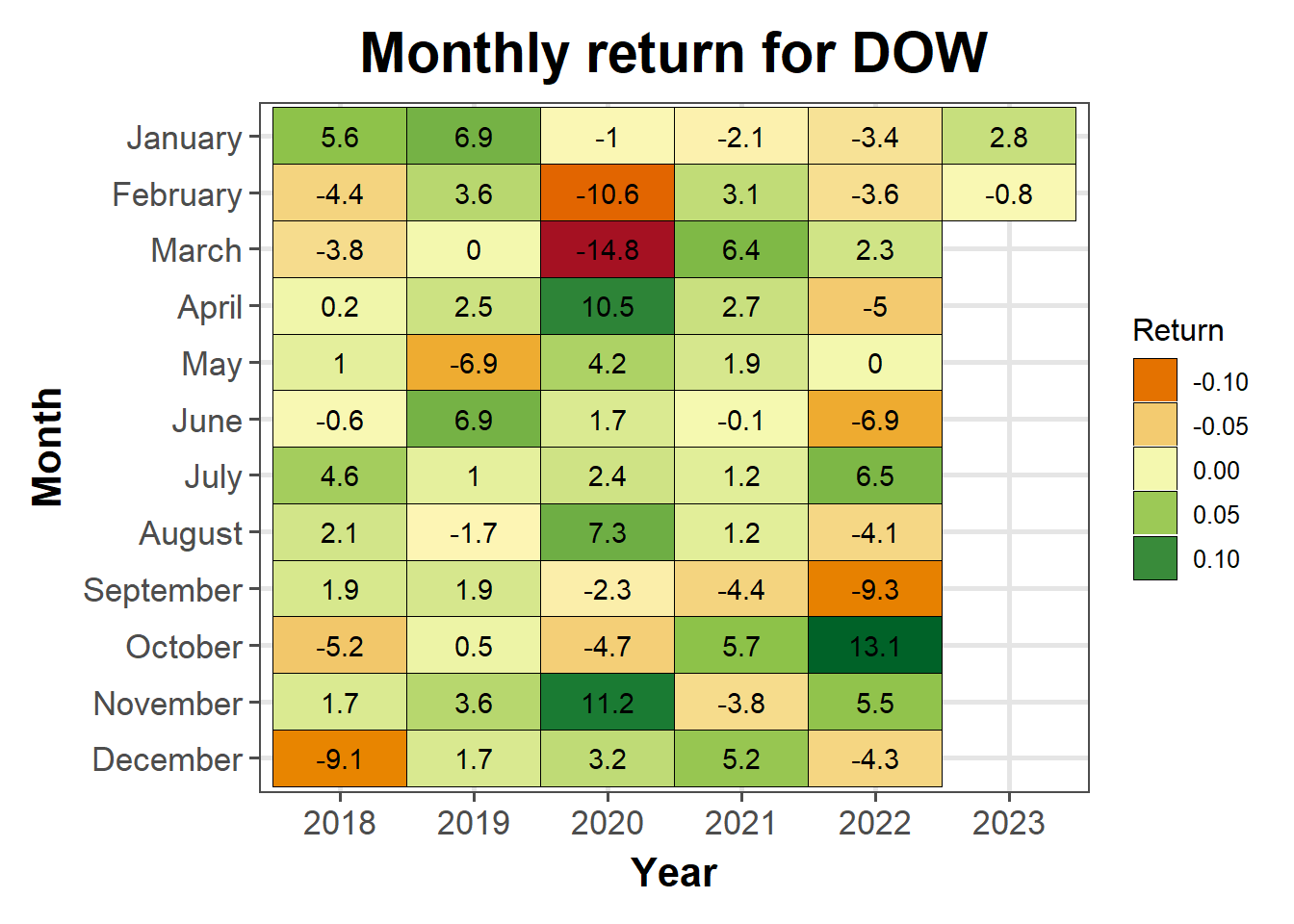

DOW Jones

DOW stayed pretty much flat with a 0.1% loss. It lost 0.8% month to date

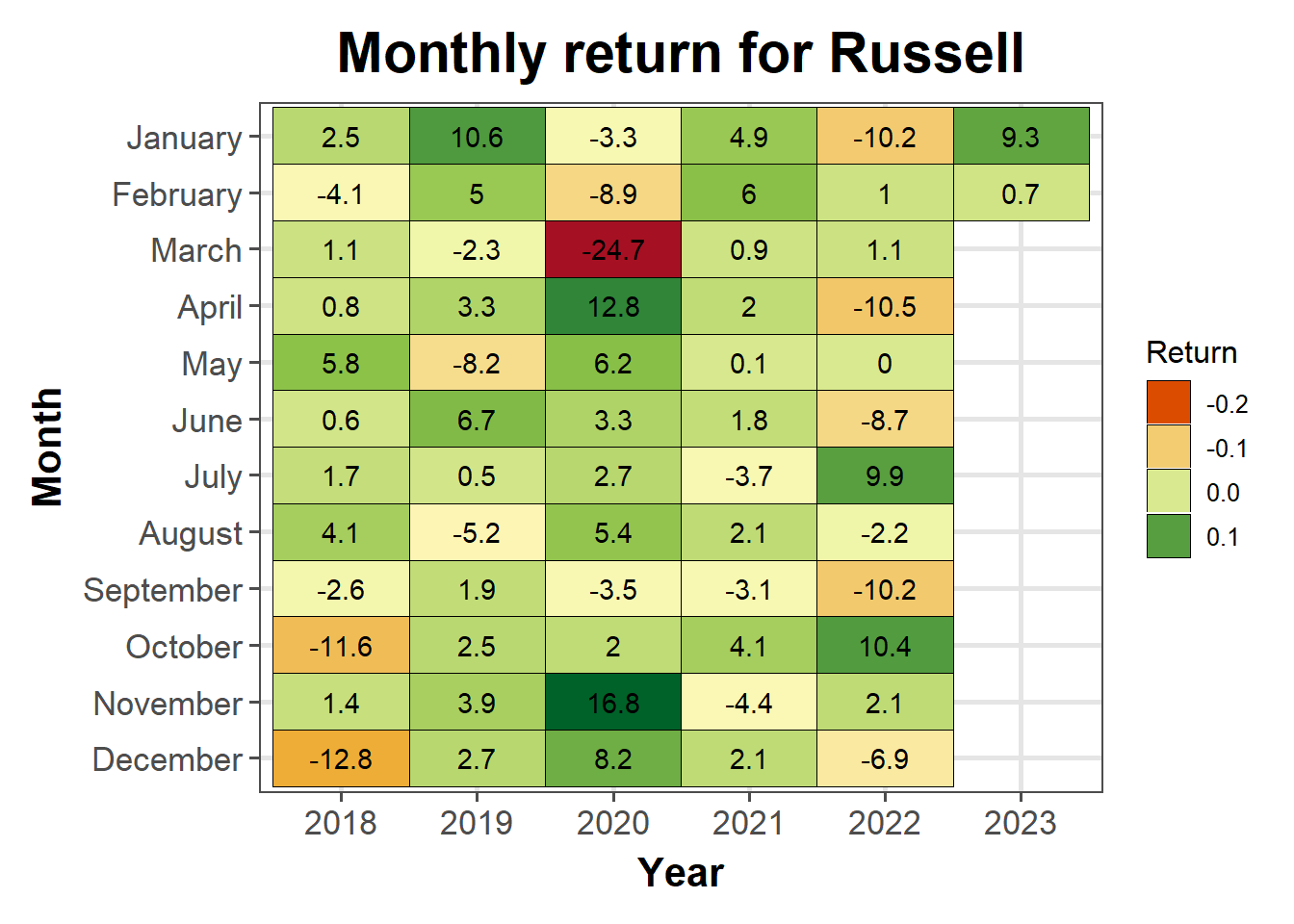

Russell

Small cap stocks gained ~1.4% for the week

Bond markets

## [1] "DGS3MO" "DGS6MO" "DFF" "DGS1" "DGS2" "DGS5" "DGS7" "DGS10"

## [9] "DGS30"

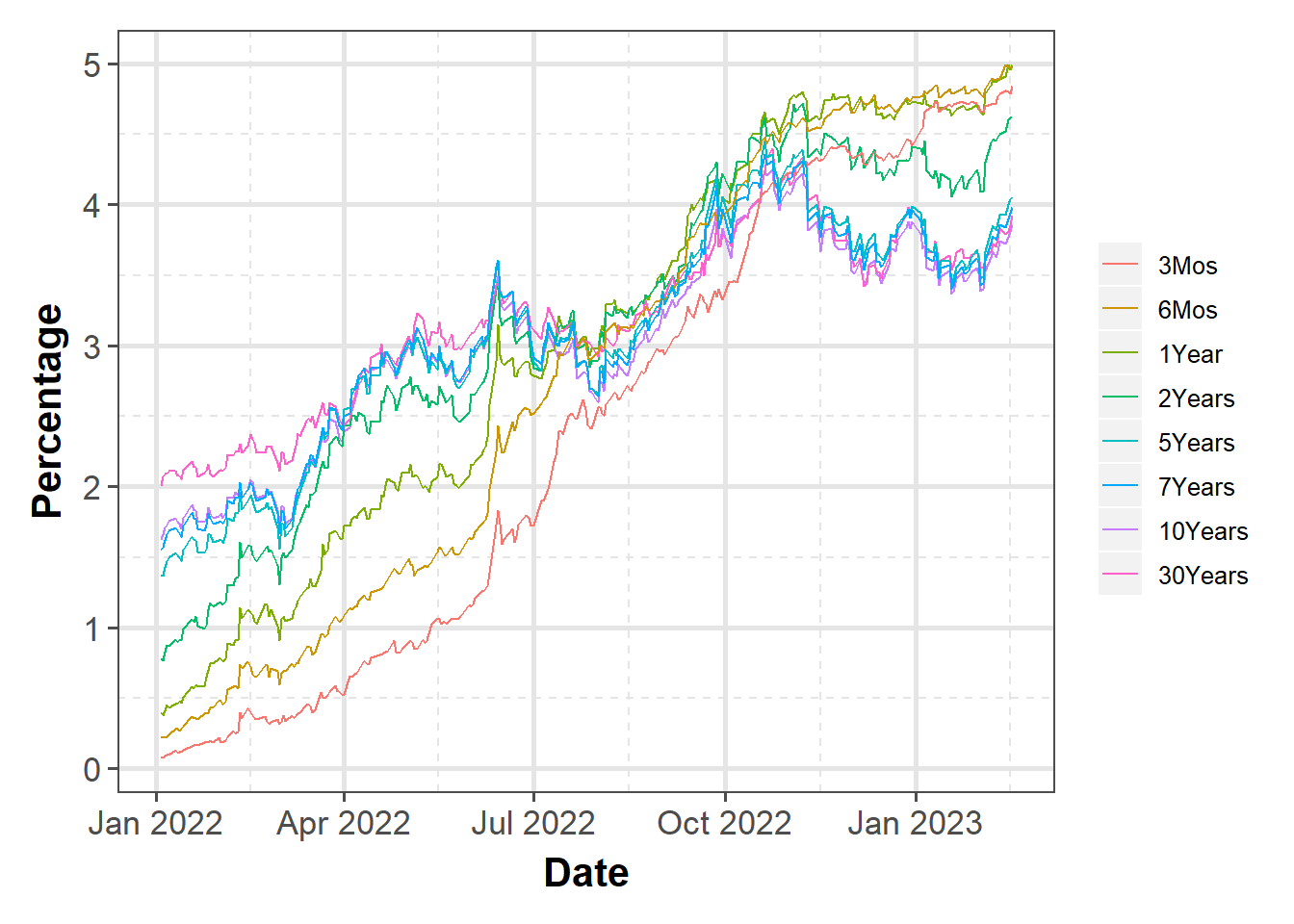

Interest rates

Longer term interest rates for treasuries are trending down while shorter term rates are staying flat to slightly down for the year.

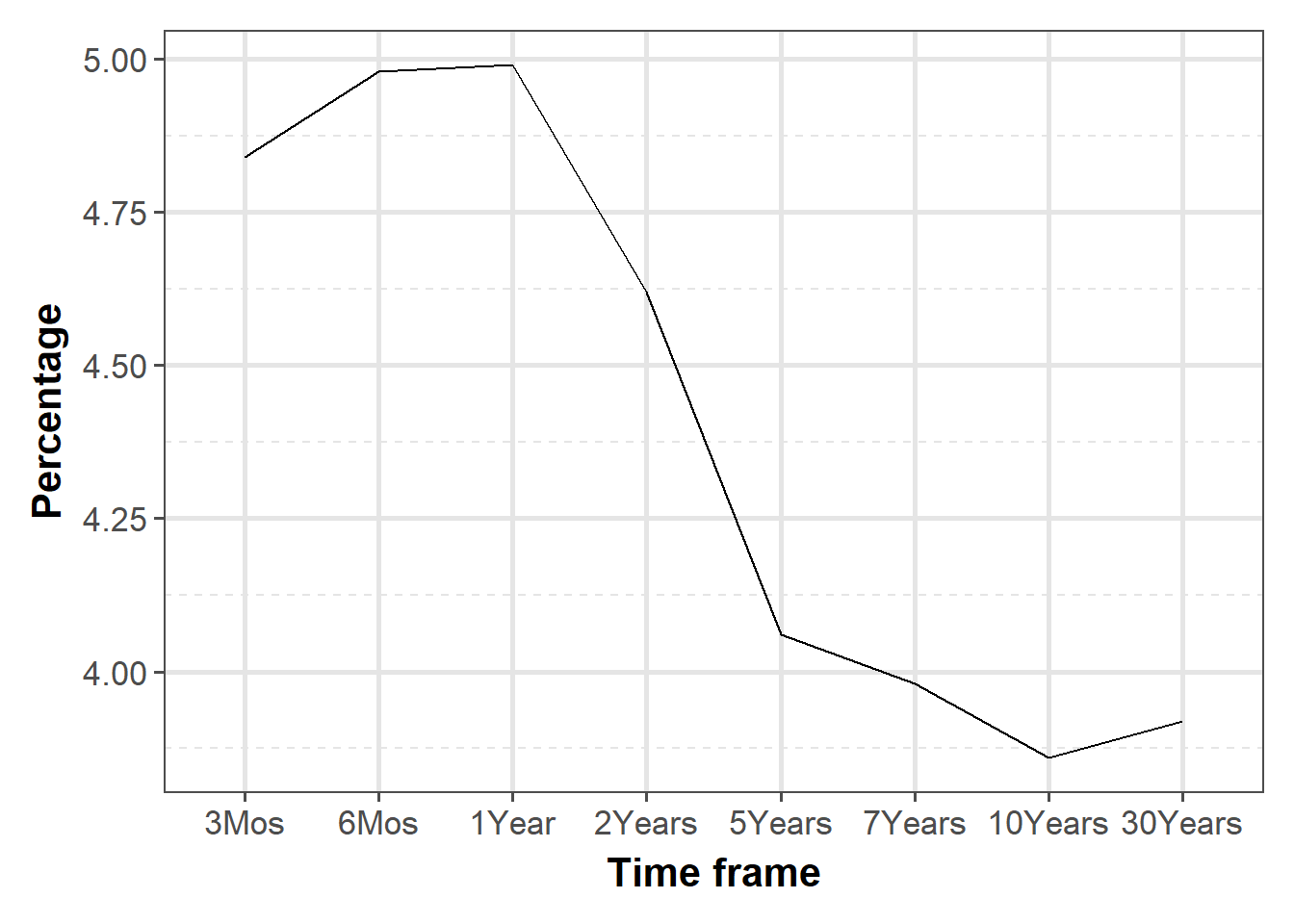

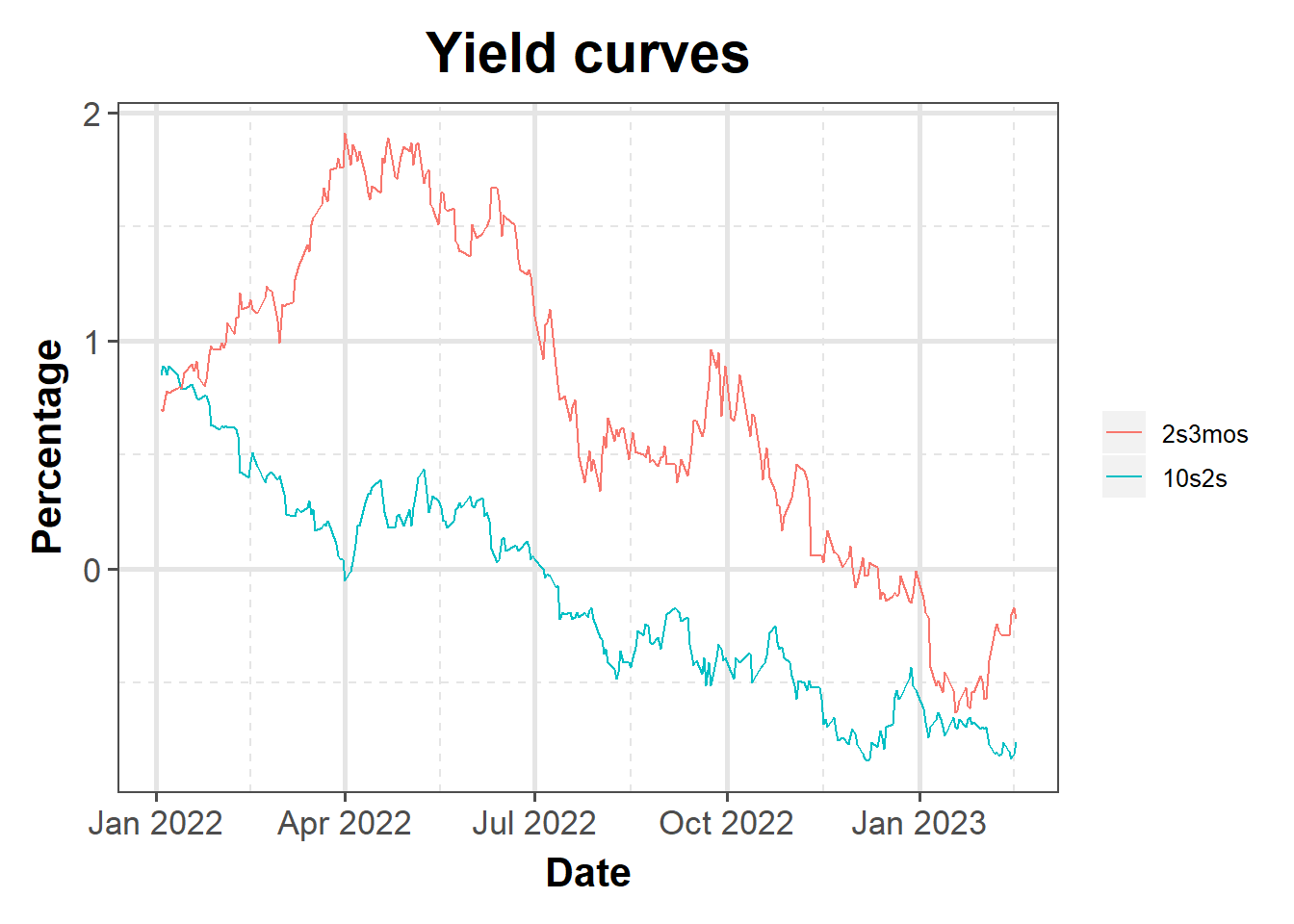

Yeild Curve

Yield curve continues to slope negatively (inverted). At the higher end, it appears that it is starting to slope positively or flat but at the lower end, it still slopes significantly negative

Disclaimer

Anything on this blog is not an investment advice. It is essential that you fully understand the risks involved before making any investment decisions. You should consult with a financial professional to help you assess your risk tolerance and to determine an investment strategy that is suitable for your individual needs.

Please note that this disclaimer is not exhaustive and is provided for informational purposes only. Investing involves risks, and it is your responsibility to carefully consider the risks before making any investment decisions.